Fact Sheet

The Norwegian Agency for Local Governments

- Established by an Act of Parliament 1926/1999.

- 100% central government owned - KBN is classified as a state instrumentality serving a public policy function of providing low-cost funding to the Norwegian local government sector.

- Excellent asset quality, no loan losses in almost 100 years of operations.

- KBN represents the closest proxy to Norwegian sovereign risk in international markets.

Objective

To provide loans on favourable terms to the Norwegian local government sector. KBN’s mandate also involves promoting competition in the market for municipal loans thereby facilitating the efficient provision of public services in Norway. KBN has also been given a mandate from the government to implement greater environmental awareness in the local government sector through our green lending program and is seen as an important contributor toward Norway fulfilling its climate commitment under The Paris Agreement (COP 21)

KBN contributes to sustainable social development and long-term value creation by operating its business in a responsible way paying attention to environmental, ethical and social issues.

Funding

The objective of KBN’s funding operations is to meet growing borrowing requirements through a well-diversified funding base.

KBN is committed to preserving long-term investor relationships through:

- Regular issuance of strategic benchmark transactions in USD and EUR.

- A visible presence in other institutional public markets.

- An issuer of private placements offering investors a variety of currencies and tenors in both plain vanilla and structured format.

KBN is targeting an estimated total issuance of USD 10-12 billion equivalent in 2025. In 2024, KBN raised USD 8.6 billion equivalent via its diversified funding program. This was achieved via 38 individual transactions across 9 different currencies.

About Norway and Norwegian economy

A provider of vital services to the Norwegian public, in areas such as healthcare, education, transport and infrastructure.

«Acting largely as a state instrument, KBN performs an important public policy function in providing low-cost funding to the Norwegian LRG sector and in promoting competition in the municipal loan market.» (Standard & Poor’s – September 2024).

The close relationship between the central government and the municipal sector is characterized by strict central regulation and oversight. The Norwegian government also showed this support throughout the Covid-19 outbreak, whereby it compensated municipalities and counties for extra costs and revenue shortfalls linked to pandemic. This enabled local governments to maintain their activities and economic stability.

Counties and municipalities - KBN's clients - under the Local Government Act may not be subject to bankruptcy proceedings (Local Government Act §55).

The Kingdom of Norway (AAA/Aaa) is a strong, open, diversified economy with solid fundamentals and a highly developed industrial base. Norway has one of the world’s highest GDP per capita and topped the 2018 UN Human Development Index. The government has managed a solid current account surplus for the past decades and estimates continued large surpluses going forward.

As evidenced in the Key Economic Indicator table (below), Norway similar to many other advanced economies, experienced higher inflation and elevated energy prices throughout 2022 and 2023. Inflation has declined markedly since its peak (both internationally and in Norway) but Norge’s Bank kept its policy rate at 4.5% throughout 2024, as inflation moved closer to targets. It is now likely that Norges Bank will lower the policy rate throughout 2025 as inflation continues to trend toward targets.

Norwegian economic activity continued to improve throughout 2024 and growth picked up compared to 2023. Activity was lifted by high public demand and robust investments in the petroleum industry, but contrasted with lower activity in housing investment and construction. Norwegian unemployment remains at a very low level, albeit slightly up compared to 2023. Norwegian household consumption is expected to rise as rate expectations come down and households have experienced solid wage growth in recent years. The economic outlook for both Norway and it’s international trading partners remains relatively uncertain, especially if international trade barriers and tariffs are increased. Norway’s fiscal strength however, remains firmly intact.

A large exporter of energy, Norway’s current account surplus remains very solid and is forecast to be 14.3% in 2025.

Currently, Norway’s SWF, the Government Pension Fund – Global, stands at approximately USD 1.75 trillion (approximately 350% of Norwegian GDP and 900% of the national budget). The fund has seen record inflow over the last few years and since 1998, the Fund's actual average net annual real rate of return has been over 4%. For more information on the SWF, visit www.nbim.no

Source: SSB / Norges Bank

| GDP | Unemployment | Inflation | |

| 2019 | 2,50 % | 3,70 % | 2,30 % |

| 2020 | -2,30 % | 4,60 % | 1,30 % |

| 2021 | 4,20 % | 4,40 % | 3,50 % |

| 2022 | 3,80 % | 3,30 % | 5,80 % |

| 2023 | 0,70 % | 3,60 % | 5,60 % |

| 2024 | 0,90 % | 4,00 % | 3,20 % |

| 2025E | 1,20 % | 4,00 % | 2,70 % |

Through our Green Bond program, we aim to finance the Norwegian local government sector’s transition to a climate-resilient, low carbon society. KBN aims to be a leading financial institution in the areas of climate risk, sustainability and green finance solutions.

KBN is a long-term participant in the green finance market, having established a green lending programme in 2010. In 2024, KBN passed NOK 65 billion in green lending to 537 projects in the municipal sector, a compounded annual growth rate of 25% over the last 8 years. As of January 2025, KBN had outstanding USD 4.6 billion in green bonds in six different currencies (USD, EUR, NOK, CAD, AUD and SEK), totalling 10.6% of KBN’s total borrowings.

The 2024 Green Bond Framework, replaces the 2021 version and most recent Criteria Document, and places greater emphasis on both nature- and climate-related risks.

The framework is aligned with the ICMA Green Bond Principles and has a Second Party Opinion from S&P. The SPO highlights KBN’s thorough selection process and documentation requirements, annual impact reporting and positive social benefits. It was awarded a Medium Green shading.

For more information regarding KBN Green Bonds and KBN’s Impact Reporting, please see the Green Bonds section on our website.

Contact us

| Mr. Sigbjørn Birkeland Chief financial Markets officer |

Thomas Møller Head of Funding & IR |

|

|

| +47 934 80 893 sib@kbn.com |

+47 21 50 20 41 +47 982 47 041 thm@kbn.com |

| Evan Morgan Senior VP, International Funding |

Marius Ruud Senior VP, International Funding |

|

|

| +47 21 50 20 48 +47 982 47 048 erm@kbn.com |

+47 21 50 20 43 +47 982 47 043 mar@kbn.com |

| Georg Fuglesang VP, International Funding |

|

|

|

| +47 21 50 20 49 +47 913 41 387 gef@kbn.com |

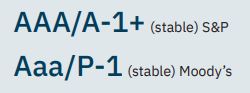

Credit ratings

Click on the image for larger version

Click on the image for larger version

Click on the image for larger version