Successful 5-year USD Benchmark

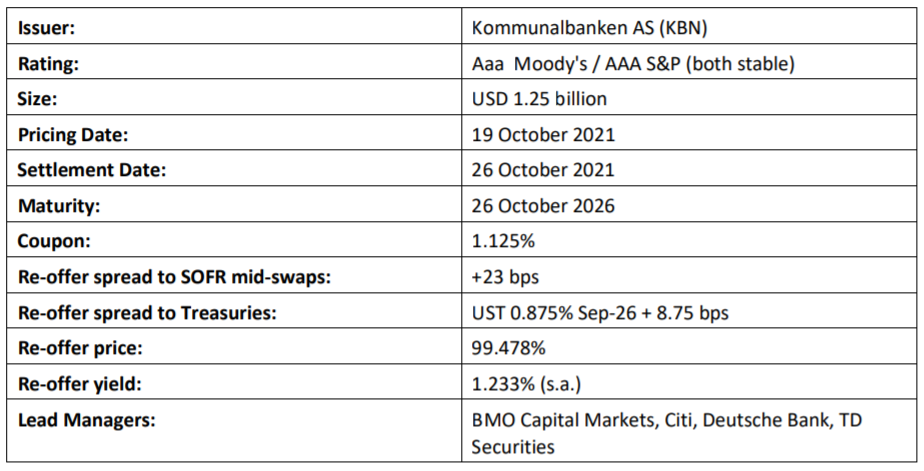

On Monday 18th October KBN successfully issued a new USD 1.25 billion 5-year RegS/144A benchmark.

The issuance represents KBN's second new 5-year USD Benchmark of 2021, having already issued in fixed-rate format in 2-year and 3y-year (Green Bond), as well as an inaugural 2-year SOFR Floating Rate Note.

"This trade ticked two boxes, our first USD benchmark marketed against SOFR-Mid swaps and our tightest ever 5y benchmark print against UST, a good finish to our 2021 USD fixed benchmark program", says Head of Funding and IR at KBN, Thomas Møller.

KBN announced a mandate for a new 5y USD benchmark at 11:52am CET on Monday 18th October, alongside Initial Price Thoughts (IPTs) of SOFR mid-swaps + 24 basis points. KBN have been a leader in transitioning the market towards the usage of SOFR, having already issued a SOFR FRN this year. The use of SOFR mid-swaps as their pricing reference for this transaction is another significant milestone in the market's journey away

from LIBOR.

The final order book was in excess of USD 1.9 billion, from over 30 investors, allowing KBN to comfortably launch a USD 1.25bn sized transaction.

Distribution Statistics:

|

By Geography |

By Investor Type |

||

|

EMEA |

53.7% |

Banks |

50.1% |

|

Americas |

45.1% |

Fund Managers |

29.0% |

|

Asia |

1.2% |

CB/OIs |

20.8 % |

Joint Lead Manager Quotes:

“Many congratulations to the KBN team for another successful outing in the USD fixed rate benchmark market. Pricing at a spread of +8.75 vs Treasuries (and +7.6 on a curve adjusted basis) represents the tightest level that KBN has ever achieved vs Treasuries for a USD 1bn+ benchmark, testament to the ongoing strong sponsorship that they continue to enjoy from investors around the world.”

- Massimo Antonelli, Managing Director, BMO Capital Markets

"KBN have achieved another excellent result with their fourth fixed rate dollar outing this year. The high quality orderbook allowed KBN to price at their tightest spread to treasuries for a 5-year issue since June 2019. This transaction marks the first time KBN prices a fixed-rate benchmark using SOFR mid-swaps, joining the ranks of the few but growing number of SSA issuers spearheading the shift away from marketing new issues vs Libor. Citi is delighted to have been involved on this successful trade"

- Ebba Wexler, Managing Director, SSA DCM, Citi

“A tremendous outcome for the KBN team once again, launching a highly successful US$ 1.25 billion 5-year benchmark

at an attractive level despite a fairly busy primary market. This marks KBN’s first fixed rate US Dollar new issue marketed

vs SOFR mid-swaps as the issuer fully embraces the new reference rates. With an oversubscribed orderbook in excess

of US$ 1.9 billion, backed by high quality demand from the central bank/official sector as well as fund managers and

banks, KBN continues to enjoy an exceptionally diverse investor following. Deutsche Bank is delighted to have been

involved in this US Dollar benchmark financing.”

- Pieter van Blommestein, SSA DCM Origination, Deutsche Bank

"Congratulations to the KBN team on successfully issuing their fourth fixed-rate USD trade of 2021. Having issued a

SOFR FRN earlier this year and now utilizing SOFR mid-swaps in this transaction KBN continue to champion the move

away from LIBOR. Achieving attractive pricing, at just UST+8.75bps, in such a dynamic rates environment is a testament

to KBN's market intelligence and loyal investor base"

- Mark Byrne, Director, SSA Syndicate, TD Securities