KBN returns to the Kangaroo Green market

A highly successful transaction marks KBN’s return to the Kangaroo Green market since their inaugural offering in 2018.

On Tuesday 28th September, KBN priced a new AUD300 million 3-Year Green Kangaroo Bond at ASW+6bps.

- We are very pleased to be back in the Kangaroo market with our first AUD outing in green format since our highly successful inaugural green Kanga trade back in 2018, says Thomas Møller, Head of Funding & IR at KBN.

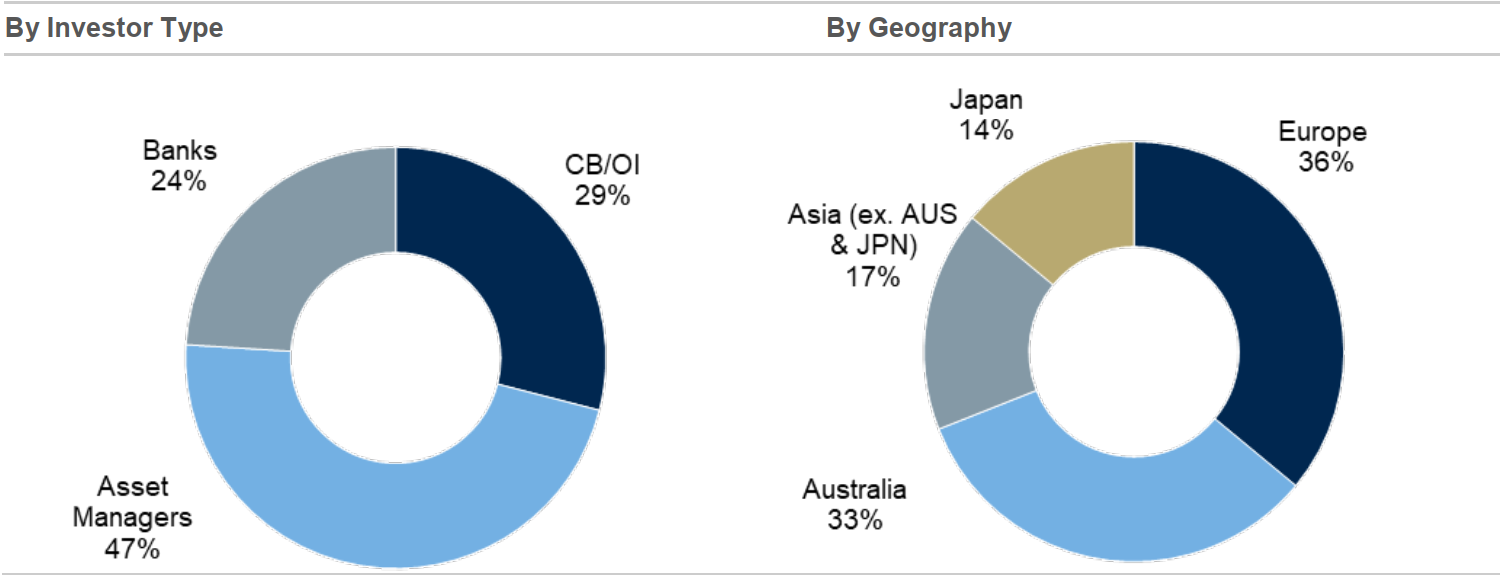

The final re-offer spread of ASW+6bps s/q marks KBN’s tightest ever Kangaroo Bond. Combined orderbook closed in excess of AUD370 million (incl. AUD75m JLM) from over 20 accounts, with particularly strong domestic participation (33%).

- The transaction gathered broad international support in addition to solid domestic uptake and we consider this another successful milestone in KBN's longstanding committment to the AUD Kangaroo market extending for over 20 years, says Møller.

A total of 75% of the transaction was allocated into ESG-motivated accounts, with the deal diversified across Dark Green (39%), Medium Green (19%), Light Green (17%) and non-ESG accounts (25%).

Net proceeds from the Green Bond will be utilised according to the KBN’s Green Bond Framework, which has received a governance score of “Excellent” and a ‘Medium Green’ second opinion by Cicero Shades of Green. The Framework and Second Opinion are available on: https://www.kbn.com/en/about-us/news/2021/kbn-launches-updated-green-bondframework/

Final Terms

| Borrower: | Kommunalbanken AS (“KBN”) |

| Ratings: | Aaa (Stable) / AAA (Stable) by Moody’s / S&P |

| Format: | Kangaroo |

| Pricing Date: | 28th September 2021 |

| Payment Date: | 8th October 2021 (T+7) |

| Coupon: | 0.500%, semi-annual, RBA bond basis |

| Size: | AUD 300 million |

| Maturity Date: | 8th October 2024 |

| Re-offer Spread: | ASW+6bps s/q | ACGB Apr-24 + 55.75bps | ACGB Nov-24 + 27.25bps | EFP +11.5bps |

| Joint Bookrunners: | Nomura, RBC Capital Markets, TD Securities |

Sales Distribution

Source: Joint Bookrunners